tax abatement nyc meaning

25 Years ICAP Tax Abatement Low Common Charge. Email protected email protected Details of the different restrictions that apply in Wales can be found on the Welsh Department heads are required to file Form 44 Statement of City-related Business when City action affects the following personal financial interests.

How Much Is The Coop Condo Tax Abatement In Nyc

Hi Venkat if for the tax year in question you met the test to be classified as a resident for tax purposes an FBAR would be required for that tax year.

. If your frozen rent is based upon the legal regulated rent the next time you renew if you continue to meet all eligibility criteria your rent may be re-frozen at the preferential rent amount on the lease in effect June. Youll need a distinctive font and logo. Email protected 3 reduction in federal income tax liability.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. 2351 Adam Clayton Powell 619 is a sale unit in Central Harlem Manhattan priced at 1025000. All our academic papers are written from scratch.

Person for being subject to the FBAR filing requirements. March 02 2021 1015 AM. The tax exemption provides temporary relief from an increase in real estate taxes that would otherwise result from the increase in assessed value of the property due to such eligible work.

The tax abatement for this project came out to. Tax and Legal. The buildings design was intended to fit its surroundings with a.

Meaning consumers will access the stored power via the electric grid. All our clients are privileged to have all their academic papers written from scratch. Morgan Bank Building or Deutsche Bank Building is a 55-story 745-foot-tall 227 m skyscraper on Wall Street in the Financial District of Lower Manhattan in New York City United StatesThe tower was designed by Roche-Dinkeloo and originally built for JP.

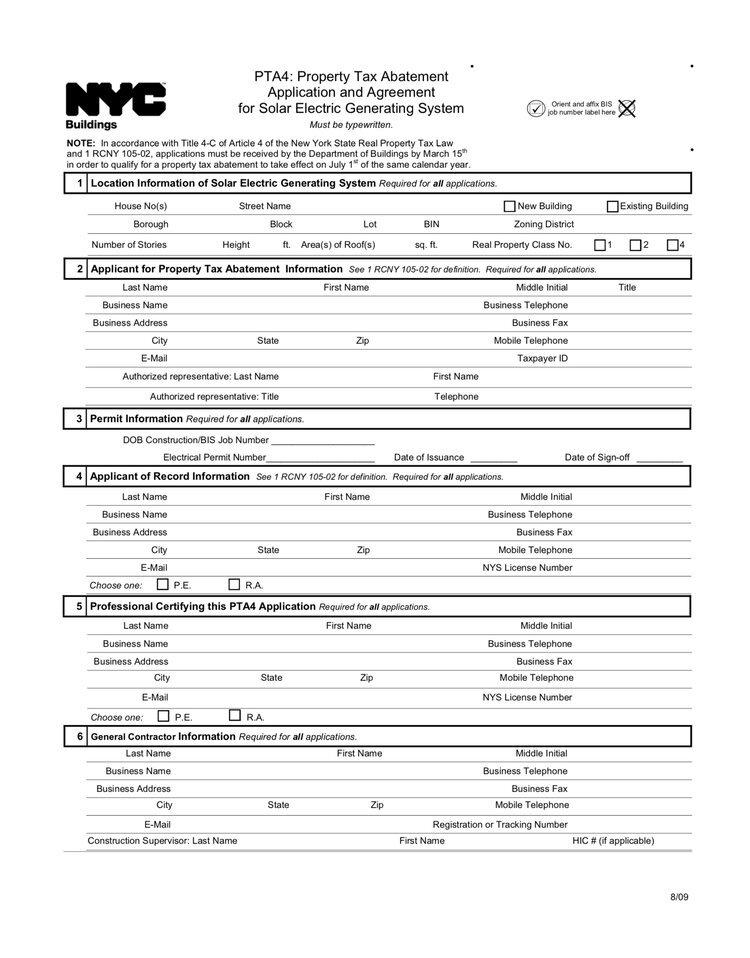

New York City Property Tax Abatement People living in New York City can also take advantage of the property tax abatement run by the NYC Department of Buildings. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Homeowners who have installed a solar PV system are eligible for a property tax abatement equal to 20 of the total system cost after rebate applied against their property taxes over four years.

Both the NYC and Illinois portfolios are slated to. The tax abatement credit issued to landlords will be based upon rent guidelines board increases to the preferential rent amount For current Rent Freeze Program participants. 60 Wall Street formerly the JP.

Free Apns For Android. Later Warren de Blasio-Wilhelm is an American politician who served as the 109th mayor of New York City from 2014 to 2021. Learn everything an expat should know about managing finances in Germany including bank accounts paying taxes getting insurance and investing.

میهن بلاگ ابزار ساده و قدرتمند ساخت و مدیریت وبلاگ. The tax abatement reduces or eliminates existing real estate taxes based on a percentage of the cost of the work that was performed. An official transcript has been embossed and placed in a sealed envelope with an Official Transcript seal on the back of the Ordering your tax transcript is a technique a lot of folks attempt to use to get an update on their tax return processing and refund status if they are not getting information or.

Get 247 customer support help when you place a homework help service order with us. De Blasio was born in Manhattan and raised primarily in Cambridge. Real or personal property a City contract a grant a loan a forgiveness of debt or an application for a.

The lien protects the governments interest in all your property including real estate personal property and financial assets. A New York City program that privatized control and management of some public housing lacks adequate oversight and protections for residents rights Human Rights Watch said in a report released. با قابلیت نمایش آمار سیستم مدیریت فایل و آپلود تا 25 مگ دریافت بازخورد هوشمند نسخه پشتیبان از پستها و نظرات.

Wages of executive administrative and professional employees as defined in the Federal Fair Labor Standards Act of 1938 may be paid on or before 21. If youre filing a New York return for tax year 2021 and have a New York-issued ID youre required to enter the document number in addition to your ID NYC Inmate Lookup NYC Central Booking and Arraignments NYSID number This is a unique number that DCJS assigns to your recordAdministers retirement benefits for 300000 active and retired NYC workers. R5D R6A R6B R7A R7B R7D R7X R8A R8B R8X R9A R9D R9X R10A R10X a In R6A R6B R7A R7B R7D R7X R8A R8B R8X R9A R9D R9X R10A or R10X Districts any building or other structure shall comply with the bulk regulations for Quality Housing buildings set forth in this Chapter and any building containing residences shall also comply with the requirements of.

In essence any tax year you are classified as a resident for tax purposes you are considered to be a US. Your grades could look better. Bill de Blasio d ɪ ˈ b l ɑː z i oʊ.

Born Warren Wilhelm Jr May 8 1961. Brand New Community Facility For Sale. Between 1939 and 1941 as a means to assess real property for tax purposes the city took photographs of every building in NYCs five boroughs producing 720000 black and white images.

United States NYC-based Claircompleted a 15 millionSeries A funding round bringing its total funding to 19. A member of the Democratic Party he held the office of New York City Public Advocate from 2010 to 2013. Also most free antivirus apps scan.

Located in the heart of Queens where Flushing meets Kew Garden Hills Parsons Garden One is surrounded by some of the citys best parks and recreation including Flushing Meadows Corona Park Kissena Park and Golf Course the USTA Tennis Center and. New York Mar. Jan 21 2022 The entire area around Times Square is secured with barricades and you can only enter the viewing area through designated entry points.

Bi-weekly and the number of exemptions claimed on the employees IRS Form W-4.

The Real Reasons Your Home Is Not Selling Buying A Condo Reasons Building Management

Nyc Solar Property Tax Abatement Pta4 Explained 2022

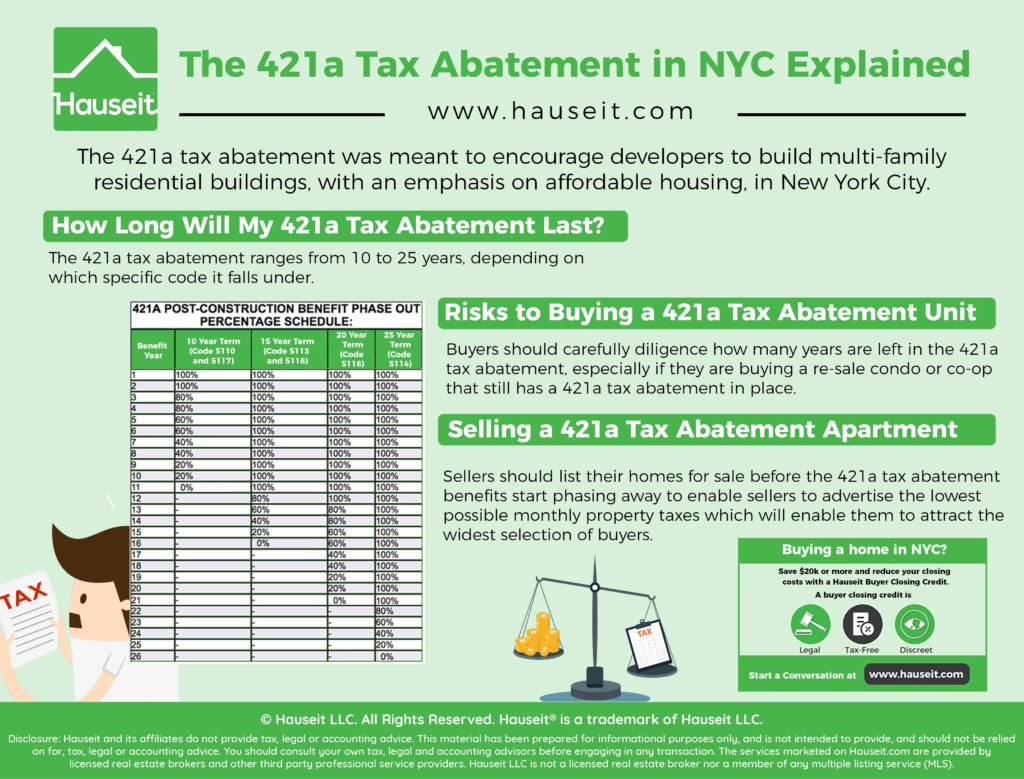

The 421a Tax Abatement In Nyc Explained Hauseit

What Is A 421a Tax Abatement In Nyc Streeteasy

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

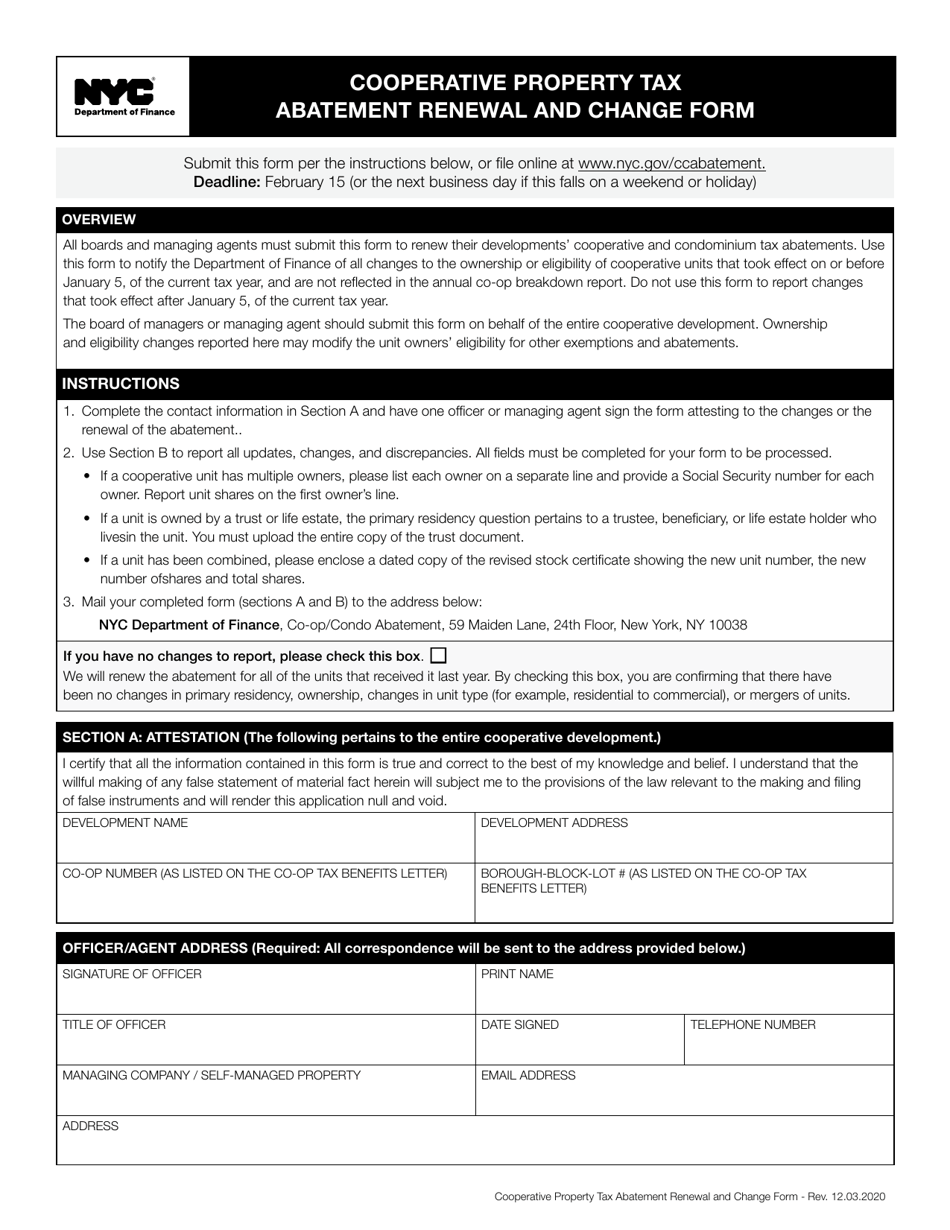

New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How Much Is The Coop Condo Tax Abatement In Nyc

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Sell Apartment Online Hauseit Sale House Apartments For Sale Apartment

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be

The 421a Tax Abatement In Nyc Explained Hauseit

Tax Abatement Nyc Guide 421a J 51 And More