geothermal tax credit new york

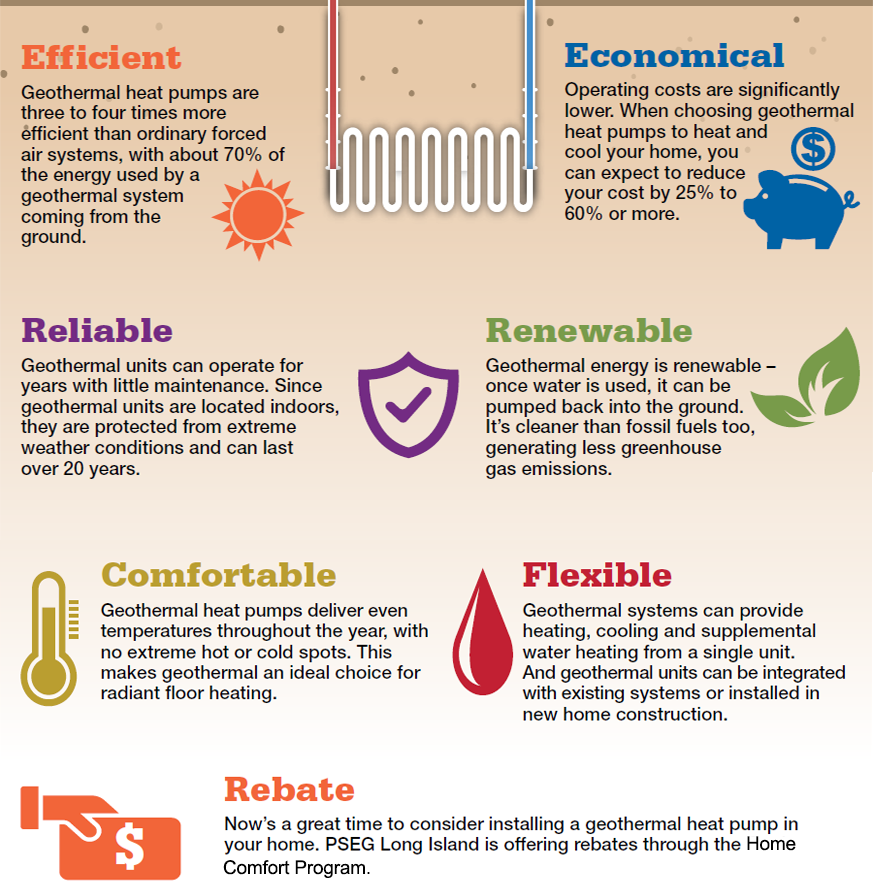

Credits have been extended to December 31 2021. If the federal tax credit exceeds tax liability the excess amount may be carried forward into future years.

Incentives Aces Energy Wny Geothermal And Solar Installer

New 5000 tax credit in New York State.

. March 5 2022. Located in New Rochelle serving the greater Tri-state Area. The new state budget that was just passed last week includes a 5000 tax credit for all residential geothermal installations for the next 5 years.

The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years if their New York income tax liability is less than 5000When coupled with the 26 federal tax credit and rebates provided by New Yorks utilities this new income tax credit will help make geothermal systems even more. Lets go over some important details to explain how these incentives are allocated. Did you your spouse or your dependent attend college.

The Geothermal Tax Credit is classified as a non-refundable personal tax credit. It now is before Governor Andrew Cuomo for signature and adoption or veto. You can claim the credit for your primary residence vacation home and for.

The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT. The most commonly used forms and instructions are listed here. Dandelion Energy the nations leading home geothermal company celebrates the passing of the New York state budget which includes a new tax credit for residential geothermal heat pump installations in New York.

These tax credits are retroactive to Jan 1 2017. Tax Credits Incentives. If youre a New York State resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

Home geothermal systems earn New York. NY State Legislature Passes Geothermal Tax Credit. When coupled with the 26 federal tax credit and rebates provided by New Yorks utilities this new income tax credit will help make geothermal systems even more affordable for New York homeowners.

In order to qualify for the Federal Tax Credit you must have some level of. Additionally homeowners are eligible for New York States Clean Heat Program which is administered by the homeowners utility. Save up to 50 on your utility bill while lowering your carbon footprint.

A one-time tax credit of 30 of the total investment for homeowners who install residential ground loop or ground water geothermal heat pumps a one-time tax credit of 10 of the total investment for building owners who install a commercial geothermal system. New York State offers several New York City income tax credits that can reduce the amount of New York City income tax you owe. Its a dollar-for-dollar reduction on the income tax you owe.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Taxpayers could get a tax credit equal to 25 on geothermal energy system expenditures up to 5000 according to a budget bill introduced by the Assembly. Combined with the current 26 federal tax credit for geothermal systems state incentives now give residents in most parts of New York an average of 50 reduction in what the usual costs of geothermal would be.

In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. Federal Geothermal Tax Credits. The Ne w York State Assembly and Senate have passed the Geothermal Tax Credit bill A2177A A2177A-2015.

We also encourage you to consult an accountant or tax advisor if you have any questions. New York City families who were not automatically enrolled in the Biden administrations expanded monthly child tax credit can call 311 to make an appointment for one-on-one help Mayor Bill de. Spending on geothermal heat pump property adds to your homes cost basis but also must be reduced by the amount of the tax credit received.

Im very excited to tell our customers who have already been installed this year that they have a surprise extra 5000 coming their way. Lets break down what that means. Combined with a rebate from the New York State Energy Research and Development Authority and a 30 percent federal tax credit about 10000 to 12000 can be shaved off a system that can cost.

The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years if their New York income tax liability is less than 5000When coupled with the 26 federal tax credit and rebates provided by New Yorks utilities this new income tax credit will help make geothermal systems even more. New Yorkers have more reason than ever to move towards air and ground source heat pumps. The New York Geothermal Energy Organization is a non-profit organization representing ground source heat pump GSHP installers manufacturers distributors general contractors engineers renewable energy consultants and industry stakeholders from throughout New York State.

This bill allows for a 25 state income tax credit up to a maximum of 5000 for a new geothermal HVAC system. The Renewable Heat Now Campaign is organizing to win funding and policies that will get fossil fuels out of our buildings affordably and equitably The legislative package includes a geothermal tax credit S3864A7493 and sales tax exemption S642aA8147 as well as the All-Electric Building Act S6843a A8431 that would sunset fossil fuels in new construction starting. A Federal Tax Credit of 30 also is now available.

New York offers state solar tax credits capped at 5000. Are you a full-year New York State resident. They will remain at 30 until December 31 2019 at which point theyll begin a phase-out.

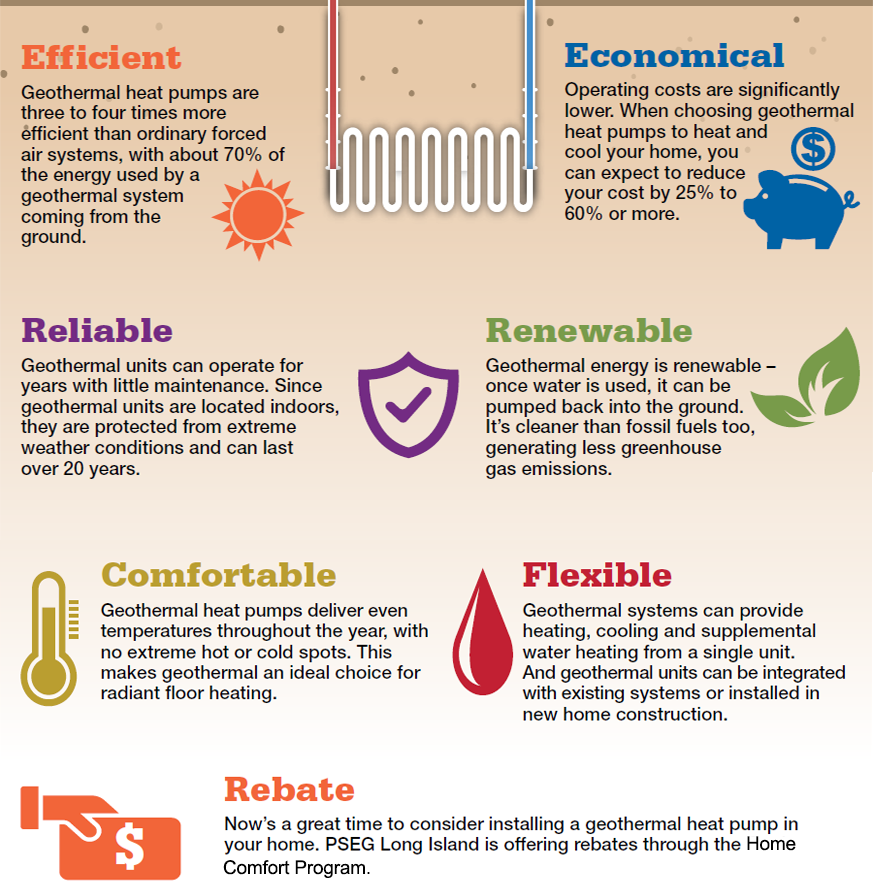

You may qualify for the refundable college tuition credit. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what you owe. Geothermal energy is the most energy efficient heating and cooling system in the world.

Serving New York and Connecticut. New York State offers a 25 tax credit on geothermal installation expenses up to 5000. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the tax credit.

Granting a tax credit and sales tax exemption for geothermal heat pump systems will make the most efficient carbon-free form of home heating more affordable for New Yorkers. New Legislation Helps NY Homeowners Fight Climate Change at Home Including Tax Credits for Residential Geothermal Heat Pumps.

Business Owners Solar Energy Solutions Solar Power System Solar

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Save Thousands On A Geothermal System Con Edison

Get Your Spring Time Energy Savings With Geothermal Pool Heating Geothermal Heating Geothermal Geothermal Heat Pumps

Geothermal Energy Pseg Long Island

The Federal Geothermal Tax Credit Your Questions Answered

Infographics Epa Releases Top 10 Cities With Most Energy Star Buildings Commercial Real Estate Energy Star Energy Greenhouse Gas Emissions

Save Thousands On A Geothermal System Orange Rockland

How Renewable Electricity Works Http Oener Gy Aboutgreen Renewable Sources Of Energy Green Energy Energy Providers

Bullitt Center Green Architecture Architecture Building Systems

Understanding Alternative Energies Renewable Energy Projects Energy Projects Wind Energy

Incentives Aces Energy Wny Geothermal And Solar Installer

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Geothermal Tax Credits Incentives

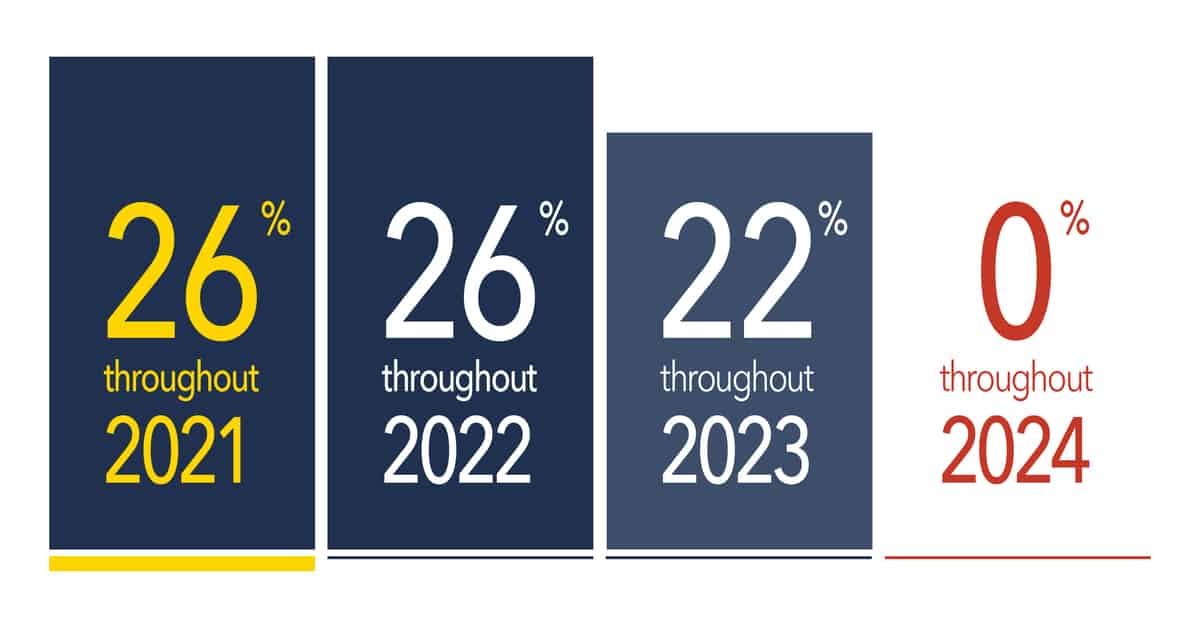

Pricing Geothermal Alliance Of Wny

New York Home Solar Panels Lower Your Utility Bill Astrum Solar Solar Panels For Home New York Homes Outdoor Solutions

Pin By Parker Public Relations On Utilities And Structure Geothermal Heating System Geothermal Heating Geothermal

The Best And Worst States To Get Solar Panels For Your Rooftop Solar Energy Facts Solar Power Solar Power House